With many new models in the works, Mahindra’s Massive Growth plan anticipates that its core vehicle business will meet high growth requirements over the coming years.

Mahindra’s Massive Growth Plan: Mahindra & Mahindra has created a long-term plan that places its automotive division at the forefront of its ten-year growth narrative. The company is now focusing on developing depth across its strongest pillars, particularly SUVs and light commercial vehicles, which remain the cornerstone of its domestic and international aspirations.

Key Details about Mahindra’s Massive Growth Plan

| Key Area | Highlights |

| Core Strategy | Car sales rise to 9.28 lakh in five years; aiming for long-term scalability |

| New Platform | NU_IQ platform to debut by 2027 with four new designs |

| Upcoming Models | XEV 9S, BE 6 Rall-E, Thar EV, Scorpio EV & more |

| EV Expansion | Strengthening leadership, multi-energy platforms and rural penetration |

| LCV Focus | Strengthening leadership, multi-energy platforms and rural penetration |

| Global Plans | Increased push in LHD & RHD markets; modular architectures |

| Financial Outlook | Automotive revenue crosses ₹90,800 crore; strong PBIT growth |

| Sales Growth | Major EV growth planned over the next 3–4 years |

Also Read:- 5 New Compact SUVs Coming to India by 2026–27 — Big Launches Ahead!

Also Read:- Mahindra XEV 9S to Launch on November 27 as Brand’s First 3-Row Electric SUV

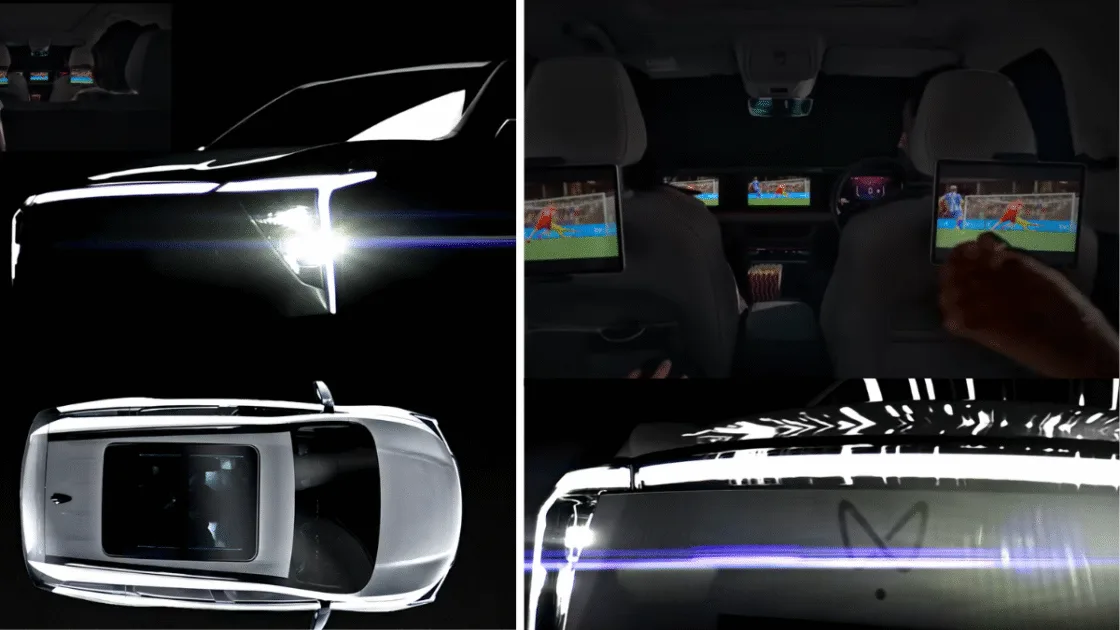

Mahindra has unveiled the NU_IQ platform on its official site, which will produce cars by 2027, along with four new designs. The company’s electric range will experience significant growth over the next three to four years, while its ICE line has just been expanded with new additions and improvements. While the BE 6 Rall-E, Thar and Scorpio EVs, as well as further new EVs, are in the works, the XEV 9S is expected to arrive shortly.

A deliberate acceleration of its automotive business is at the core of this strategy. Compared to the other firms in its group, Mahindra anticipates that its core vehicle activities will meet high growth requirements over the coming years. The main drivers of this growth are anticipated to be SUVs, which have long been the brand’s signature and LCVs, where it already has market leadership.

Instead of merely growing volume, the strategy in the LCV space is concentrated on strengthening its hold. Mahindra, which currently holds over half of the domestic LCV market in India, is now growing its market share in the sub-3.5 tonne category by creating multi-energy platforms and bolstering its presence in rural and semi-urban areas where there is still a significant and steady demand for practical commercial mobility.

Additionally, Mahindra is focusing more on both left-hand drive and right-hand drive regions in an effort to expand its global presence. As Mahindra seeks to establish itself as one of the fastest-growing SUV manufacturers in the world, new modular platforms, technologically advanced architectures and an evolving design language are being planned to support this vision.

Mahindra has stated that companies with scalable potential and sustainable returns will be given priority for future investments. Group-level PBIT has already increased over the past five years, so it is preparing to sustain consistency, improve operational effectiveness and guarantee financially sound growth over the next 10 years.

Also Read:- Nissan Tekton vs New Renault Duster: Key Design Differences Explained

Also Read:- Is Mahindra Launching a Budget BE 6? New Teaser Sparks Buzz

Mahindra’s standalone car sales have nearly risen to 9.28 lakh units during the past five years. Additionally, despite increasing overall financial efficiency across its vehicle portfolio, consolidated automotive revenues have surpassed Rs. 90,800 crore. While Mahindra Finance wants to increase its asset base fivefold while maintaining stricter control over asset quality, the farm equipment industry is aiming for a threefold increase.