Hero topped the two-wheeler sales charts in the first half of FY2025-26 (April to September), surpassing even its fiercest competitor, Honda, and other companies.

Hero MotoCorp Tops Two-Wheeler Sales in H1 FY2025-26: According to Vahan statistics, which does not account for Telangana, Hero MotoCorp maintained its top spot in the first half of FY26, while Honda and TVS Motor Company also continued to post strong results. Scooters, entry-level sports vehicles, and commuter motorcycles account for the majority of the volumes.

Key Details

| Rank | Manufacturer | Units Sold (in Lakh) | Key Models / Highlights |

| 1 | Hero MotoCorp | 24.14 | Splendor leads; strong commuter demand |

| 2 | Honda | 21.84 | Activa tops scooters; growing motorcycle sales |

| 3 | TVS Motor Co. | 17.20 | Jupiter, Apache, Raider 125, iQube EV growth |

| 4 | Bajaj Auto | 11.43 | Classic 350, Bullet 350, and Hunter remain strong |

| 5 | Suzuki | 5.23 | Access and Burgman Street drive sales |

| 6 | Royal Enfield | 4.53 | Classic 350, Bullet 350, Hunter remain strong |

Also Read:- Hero MotoCorp Breaks Records in September 2025 with 6.87 Lakh Sales and Strong EV Growth

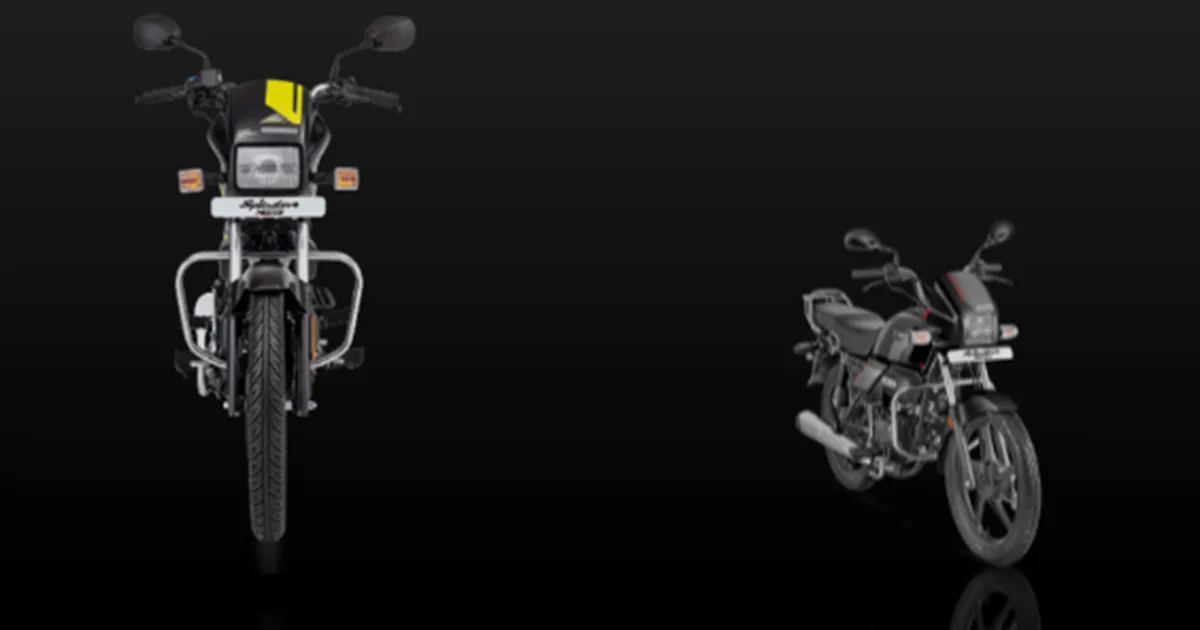

Splendor Leads Hero’s Dominance

The Splendor emerged as the primary volume contributor for the domestic manufacturer, which ended the April–September 2025 period as the undisputed leader with a total of 24.14 lakh units. Hero continues to outsell its fiercest competitor, Honda, in terms of volume sales due to the consistent demand for its entry-level vehicles.

Honda Holds Second Place with Strong Scooter Sales

With 21.84 lakh vehicles, the Japanese car giant took second place. Although the majority of Honda’s sales are still driven by its scooters, the Shine 100 and its 125 cc models have helped the company gradually increase its market share in the motorcycle segment as well. The Activa continues to be the best-selling scooter in the nation, which keeps Honda within striking distance of Hero in terms of total sales.

TVS Ranks Third with Balanced Growth

In the first half of the current fiscal year, TVS Motor Company posted 17.20 lakh units, placing it in third place. Its performance was supported as previously by steady demand for its scooters, particularly the Jupiter, and strong momentum for the Apache series in the entry-level sporty motorcycle market, but models like the Raider 125 and iQube EV also helped.

Exports Boost TVS Advantage

The company from Hosur also gains from an expanding export market, which gives it a competitive edge over some of its competitors in a wider range of markets. Bajaj Auto, with 11.43 lakh units, ranked fourth. It has maintained its resilience by using the tactic of expanding its Pulsar range in tandem with Chetak. In the upcoming years, the brand plans to significantly diversify its offerings.

Suzuki and Royal Enfield Complete the Top Six

Suzuki came in seventh place with 5.23 lakh units sold in H1 FY26. Burgman Street and others continue to support the brand’s best-selling Access scooter. Royal Enfield, with 4.53 lakh units, completed the top six. The company has maintained strong demand for its Classic 350, Bullet 350, Hunter 350, and other models, and is well-known for its slightly premium positioning while aiming for huge quantities.

Also Read:- Top 125cc Motorcycles to Buy This Diwali After GST Rate Cuts: TVS Raider, Pulsar 125, CB125 Hornet & More

Hero MotoCorp’s strong dominance in India’s two-wheeler market is demonstrated by the first half of FY2025-26, which is fueled by steady demand for its commuter models, such as the Splendor. Thanks to its growing motorbike portfolio and scooter line, Honda is still not far behind. TVS keeps growing by diversifying its product line and exporting, while Bajaj, Suzuki, and Royal Enfield maintain their pace by expanding their business models strategically. Despite economic difficulties, the overall market performance demonstrates robust competition and consumer interest across all segments.